Louisiana’s Gulf Coast faces the threat of hurricanes each year from May to November. These powerful storms can bring devastation to our communities, leaving a trail of complex challenges in their wake. In the last 20 years we’ve been hit by storms like Katrina, Rita, Gustav, Isaac, Laura, Delta, Zeta, Ida, and Francine, and have witnessed firsthand the impact on homeowners and businesses across our state.

This Storm Center is a resource designed to help you navigate the before, during, and after of hurricane season. Here, you’ll find crucial information on hurricane preparation, guidance on documenting storm damage, insights into the insurance claims process, and explanations of common issues that arise with hurricane-related claims. Whether you’re securing your home or protecting your business, this information aims to equip you with the knowledge to face whatever nature may bring our way.

On This Page

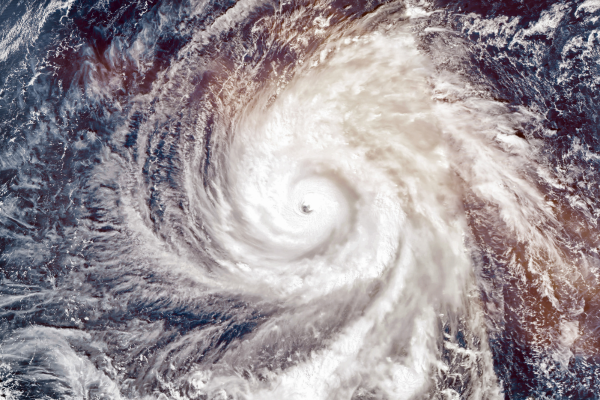

Understanding Hurricanes

Hurricanes are powerful tropical storms that form over warm ocean waters. They’re categorized on the Saffir-Simpson Hurricane Wind Scale from 1 (least severe) to 5 (most severe), based on their sustained wind speeds. These storms can bring destructive winds, heavy rainfall, storm surges, and flooding.

In recent years, Louisiana has faced many major hurricanes, including Katrina (2005), Rita (2005), Gustav (2008), Isaac (2012), Laura (2020), Delta (2020), Zeta (2020), and Ida (2021). Most recently, Hurricane Francine (2024) has left its mark on our state, with many communities still grappling with its aftermath. These events underscore the critical importance of hurricane preparedness and understanding the insurance claim process.

Hurricane Preparation Guide

Proper preparation can help minimize damage and keep you safe during a hurricane. Here are key steps to take before a storm hits:

- Secure Your Home: Install storm shutters or plywood over windows. Reinforce doors, especially garage doors, and check your roof for loose shingles. Trim trees and secure outdoor furniture to prevent debris from becoming projectiles.

- Create an Emergency Kit: Stock up on essentials like non-perishable food, water, medications, and first-aid supplies. Don’t forget items like flashlights, batteries, a battery-powered radio, and important documents.

- Evacuation Planning: Know your local evacuation routes and shelters. Have a family communication plan in place, and pack a go-bag with essentials in case you need to leave quickly.

- Insurance Preparation: Review your homeowner’s policy to understand what’s covered, including whether flood insurance is needed. Take inventory of your property, including photos and videos of valuable items, to help with future insurance claims.

Being prepared ahead of time can make a significant difference in protecting your home and family during a hurricane.

Common Property Damage Caused by Hurricanes

Hurricanes can cause extensive damage to both residential and commercial properties. Here are some of the most common types of property damage:

Visible Damage:

- Downed trees and power lines

- Broken windows and doors

- Roof damage, including missing shingles or tiles

- Flooded homes and water-damaged personal belongings

Less Obvious Damage:

- Mold and bacteria growth from water intrusion

- Contaminated water sources (sewage, oil, chemicals)

- Structural damage to walls, foundations, and electrical systems

Hurricane damage can be overwhelming, and some issues may not be immediately visible. It’s important to document everything thoroughly and seek professional help for assessing and repairing less obvious damage.

Post-Hurricane Procedures

Once the storm has passed and you’ve documented all the damage, your next steps are critical for safety and securing your insurance claim:

- Ensure Safety: Before re-entering your property, make sure it’s safe. Be cautious of downed power lines, gas leaks, and structural instability. If necessary, wait for local authorities to confirm that it’s safe to return.

- Clean Up Debris Carefully: When cleaning up storm debris, use protective gear like gloves and boots. Avoid hazardous materials and be mindful of weakened structures that could collapse.

- Make Temporary Repairs: To prevent further damage, make temporary repairs like placing tarps over roof damage or boarding up broken windows. Keep receipts and take photos of all repairs, as these costs may be covered by your insurance.

- File Your Insurance Claim Promptly: Submit your claim as soon as possible to avoid delays. Provide your documentation, including photos, videos, receipts, and a detailed damage list, to support your claim.

- Avoid Scams: Be cautious of contractors offering quick, cheap fixes. Verify licenses and credentials before hiring anyone for repairs.

By following these procedures after documenting your storm damage, you’ll not only ensure safety but also strengthen your insurance claim, positioning yourself for a smoother recovery process.

How to File a Hurricane Insurance Claim in Louisiana

Filing an insurance claim after a hurricane can be complicated, but following these steps can help ensure a smoother process:

- Document the Damage: Take clear photos and videos of all damaged areas, both inside and outside your property. Make a detailed list of affected belongings and structural damage.

- Report the Claim Promptly: Contact your insurance company as soon as possible to start the claim process. Provide them with all necessary documentation, including photos, videos, and receipts.

- Mitigate Further Damage: Make temporary repairs to prevent further damage, such as placing tarps on your roof or boarding up windows. Don’t do any unnecessary repairs at this time – repair only what you NEED to right away. Keep receipts for any materials or labor used.

- Keep Detailed Records: Maintain a log of all communications with your insurance company, including dates, times, and names of representatives. Save all receipts for repairs, lodging, and any other expenses related to the damage.

- Consult with an Attorney if Necessary: If your claim is delayed, underpaid, or denied, consider seeking legal assistance. An attorney experienced in hurricane claims can help ensure you receive fair compensation.

By taking these steps, you can help protect your rights and maximize your recovery after a hurricane.

Common Issues with Hurricane Damage Claims

Filing a hurricane damage claim can often lead to challenges with your insurance company. Many policyholders face delayed responses, underpayments, or outright denials. Below are some of the most common issues and what you should know if you’re dealing with a difficult claim:

Prompt Payment and Bad Faith

Under Louisiana law, insurance companies must investigate claims promptly and act in good faith. Bad faith occurs when an insurer is dishonest in its dealings or delays payment without a valid reason. Common examples of bad faith in hurricane damage claims include:

- Failing to begin the loss adjustment process in a timely manner

- Lack of communication with the policyholder

- Delaying the claim without proper justification

- Ignoring or undervaluing damage listed in the claim

- Misrepresenting policy terms or denying coverage without reason

- Refusing to inspect the property or share necessary reports

- Making unreasonable requests for additional documentation

If your insurer has acted in bad faith, you may be entitled to penalties up to double the value of your claim, attorney’s fees, and other damages. In such cases, consulting a legal professional is crucial to protecting your rights.

Unfair Delays in Processing Claims

After a hurricane, thousands of claims pour into insurance companies, leading to delays. However, insurers are still required to process claims in a reasonable time frame. Common tactics used to delay claims include:

- Failing to schedule inspections promptly

- Ignoring calls or emails from the policyholder

- Requiring unnecessary multiple inspections

- Asking repeatedly for new or unnecessary documentation

While some delays are inevitable after a large-scale storm, excessive delays may signal bad faith. If your insurance company is stalling, legal action may be necessary to get your claim moving.

Underpayment of Claims

Underpayment is one of the most frequent issues policyholders encounter. This often happens when insurance adjusters, overwhelmed by the number of claims, perform rushed inspections, missing critical damage. Additionally, insurance companies may use outdated pricing models to determine the cost of repairs, leading to lower payouts.

After a natural disaster, materials and labor become more expensive due to high demand and shortages, but insurance companies may not account for this. They may also try to minimize costs by recommending cheaper contractors or suggesting that items can be repaired when they need to be replaced. Common examples include disputes over whether a roof or flooring can be repaired or must be replaced.

To fight an underpayment, it’s essential to gather accurate, up-to-date estimates and consider consulting an attorney to negotiate with the insurance company on your behalf.

Disagreements on the Scope of Work

Another frequent problem is disagreements between policyholders and insurers on the scope of the necessary repairs. Insurers may claim that repairs are sufficient when a full replacement is needed. This can apply to:

- Roofs

- Siding

- Flooring

- Sheetrock

- Windows and cabinets

Limiting the scope of work helps insurance companies save thousands of dollars, often at the expense of policyholders. If you find yourself in this situation, having a lawyer review your claim can ensure that the necessary repairs are properly valued and accounted for.

By staying aware of these common issues and being proactive in documenting your damages, you can help protect yourself during the claims process. If your insurer is not cooperating, it may be time to seek legal advice to ensure you receive the compensation you’re entitled to.

Documenting Storm Damage

Accurate documentation is key to a successful hurricane insurance claim. Follow these steps to ensure you have the necessary proof:

- Take Photos: Capture clear images of all damage, both exterior (roof, windows, siding) and interior (water damage, broken items). Take photos from multiple angles.

- Record Videos: Use videos to document active leaks, electrical issues, or structural damage. This provides additional context that photos may not capture.

- List Damaged Items: Create a detailed list of all damaged belongings and property, noting their condition and estimated value. Include receipts or proof of purchase where available.

- Document Repairs: Save receipts for any temporary repairs and take before-and-after photos to show the work done.

- Track Communications: Keep a log of all communications with your insurer, including dates, names, and what was discussed.

- Save Receipts: Hold onto receipts for evacuation expenses (lodging, meals, gas) and materials used for repairs.

By organizing your documentation, you’ll help ensure a smoother claim process and protect your right to a fair settlement.

Hurricane Business Interruption Claims

Hurricanes don’t just affect homes—they can also disrupt businesses, leading to significant financial losses. If you have a business interruption insurance policy, you may be able to claim compensation for:

- Lost Revenue: If your business had to close due to storm damage, you could claim the income you would have earned during that time.

- Ongoing Expenses: Insurance may cover essential costs like payroll, mortgage, rent, or loan payments while your business is not operational.

- Relocation Costs: If your business was forced to move due to property damage, you may be eligible to recover costs associated with relocating to a temporary space.

To successfully claim business interruption coverage, it’s crucial to maintain detailed records of your financial losses, including proof of revenue before and after the hurricane, and any additional expenses incurred. Keep all documentation related to the damage, repairs, and relocation.

Being thorough in tracking these losses will help support your claim and ensure you receive the compensation necessary to rebuild and keep your business running.

Flood Claims

One common misconception is that homeowners insurance covers flood damage. In most cases, it doesn’t. To protect against flooding, especially in hurricane-prone areas, a separate flood insurance policy is typically required.

- Flood Insurance: Typically purchased through the National Flood Insurance Program (NFIP) or private insurers, flood insurance covers damage caused by storm surges, overflowing rivers, and excessive rainfall.

- FEMA Assistance: If you don’t have flood insurance and the President declares a disaster, you may be eligible for FEMA assistance, though it may not cover all your losses.

- Documenting Flood Damage: Just like with other hurricane damage, document everything. Take photos, videos, and keep all receipts related to repairs and temporary accommodations.

Understanding the distinction between hurricane and flood damage is crucial when filing a claim. Make sure you have the appropriate coverage in place before hurricane season begins.

Legal Assistance for Storm-Related Insurance Disputes

If you’re struggling with delayed, denied, or underpaid hurricane insurance claims, legal help can make a significant difference. JJC Law specializes in hurricane-related insurance disputes and can assist you in the following ways:

- Policy Analysis: We’ll carefully review your insurance policy to determine what’s covered and help you understand your rights.

- Claim Valuation: Our team works with experts to ensure the true cost of repairs, materials, and labor is accounted for in your claim.

- Negotiation and Litigation: If your insurer refuses to offer a fair settlement, we’ll negotiate on your behalf and, if necessary, take the matter to court.

At JJC Law, we work on a contingency fee basis, meaning you don’t pay us unless we recover compensation for you. Contact us today for a free consultation to discuss your case and explore your options.

More Info from Our Social Accounts

Download Our PDF Version Here: Lessons From Hurricane Ida: Take Photos of Damage

Download Our PDF Version Here: Lessons From Hurricane Ida: Take Videos of Damage

Download Our PDF Version Here: Lessons From Hurricane Ida: Document Your Repairs

Download Our PDF Version Here: How To Make An Insurance Claim – Personal Property

Download Our PDF Version Here: Hurricane Claims For Business

Download Our PDF Version Here: Hurricane Ida Insurance Claims – Public Adjusters